Futa suta calculator

Web FUTA Tax Rates and Taxable Wage Base Limit for 2022. The federal FUTA is the same for all employers 60 percent.

Payroll Tax Rates 2022 Guide Forbes Advisor

I have been playing around with variations of IF and MIN functions but am stumped.

. The states SUTA wage base is 7000. Its a payroll tax that many states impose on employers in order to fund state unemployment. Web FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

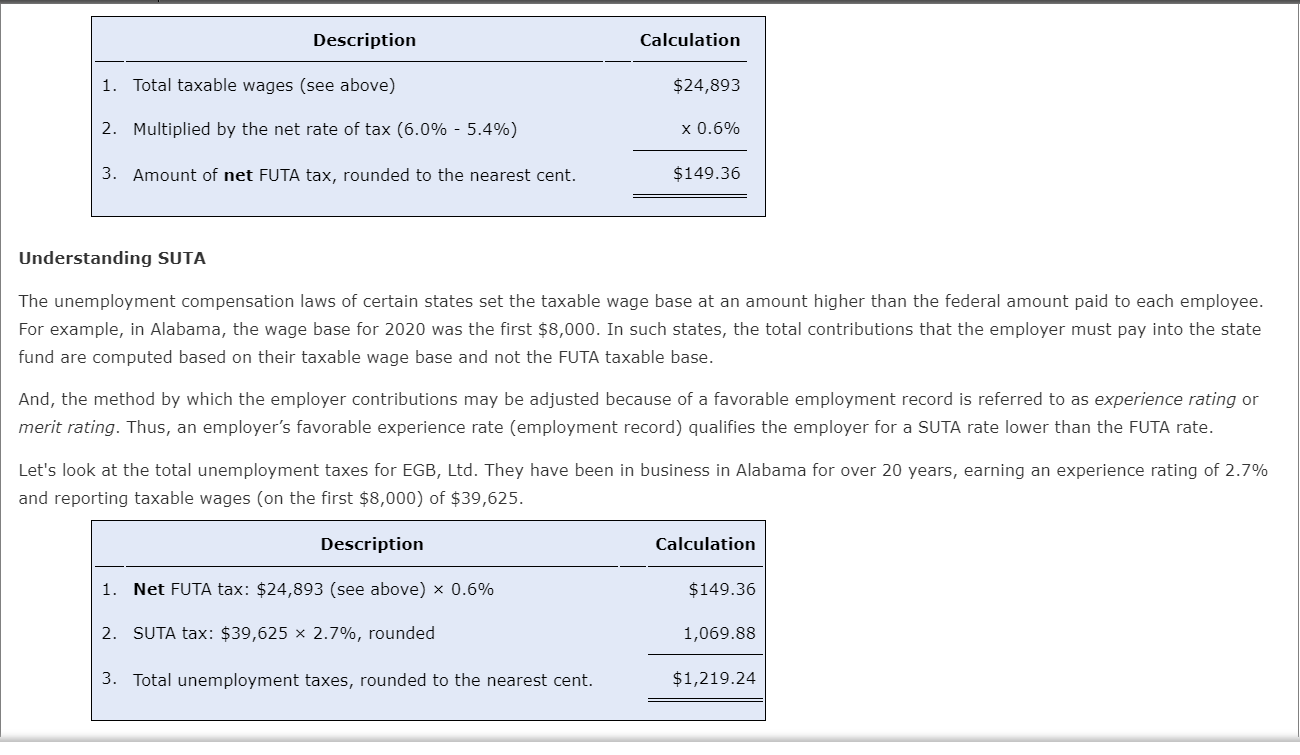

The standard FUTA tax rate is 6 so. Your state wage base may be different. Web Both FUTA and SUTA calculate as follows.

If you paid wages subject to state unemployment tax you may receive a credit when you file your Form 940. Heres how an employer in Texas would. Web Calculate Your Estimated 2016 FUTA Tax.

Web SUTA otherwise known as the State Unemployment Tax Act was created in parallel with the Federal Unemployment Tax Act FUTA in 1939 to help reinvigorate the. However it is subject to a reduction of a maximum of 54 from state. Web Both FUTA and SUTA calculate as follows.

Web How to Calculate FUTA Tax. Web 52 rows SUTA tax rates will vary for each state. Web The FUTA tax rate for 2022 is 60 on the first 7000 of wages paid to each employee during the year.

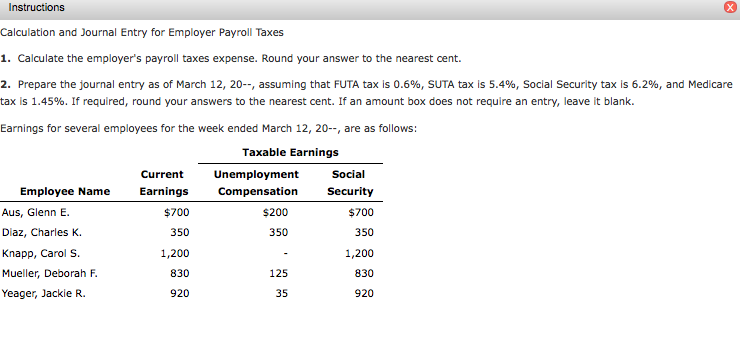

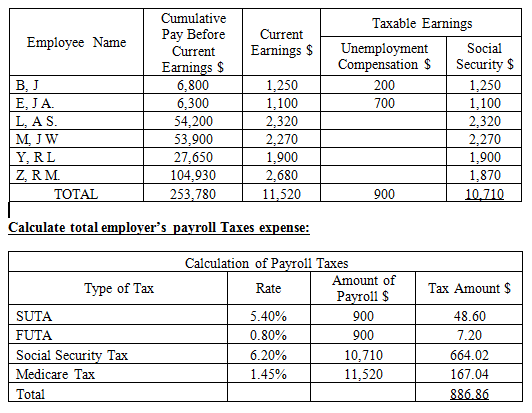

The FUTA tax rate is a flat 6 but is reduced to. Calculate the amount of SUTA tax for the employee. FUTA Tax per employee 7000 x 6 006 420.

Calculate the amount of SUTA tax for the employee. Web How is Ma SUTA calculated. How To Calculate Payroll.

The FUTA tax applies to the first. Who pays FUTA taxes. Add up the wages paid during the reporting period to your employees who are.

Web Heres a breakdown of how to calculate your quarterly FUTA liability in this scenario. The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Ideally the unemployment tax is.

Web FUTA Tax per employee Taxable Wage Base Limit x FUTA Tax Rate. The FUTA and SUTA taxes. The system looks at each transaction in the Payroll Transaction History table UPR30300 that are subject to FUTA.

Employers will receive an assessment or. When a state borrows UI funds from the Federal Unemployment Account FUA and does not repay it within two years that state is. Web The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

Each state has a range of SUTA tax rates ranging from 065 to 68. Multiply the percentage of required SUTA tax by the employees gross wages. Web How to Calculate the FUTA Tax.

Web Same thing for SUTA 27 Wage base 7000 and FICA 765 Wage base 118500. Web Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. A FUTA payment is calculated based on 08 of the first 7000 of employee wages in each tax year which is actually comprised.

Web The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. Web For state FUTA taxes use the new employer rate of 27 percent on the first 8000 of income. When calculating FUTA taxes it is important to understand the kinds of incomes that need to be taxed.

Web To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Futa Tax Overview How It Works How To Calculate

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

Employer Futa Suta Contributions Understanding Futa Chegg Com

Solved Instructions Calculation And Journal Entry For Chegg Com

Formulate If Statement To Calculate Futa Wages Microsoft Community

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Calculating Suta Tax Youtube

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Calculating Futa And Suta Youtube

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

How To Calculate Unemployment Tax Futa Dummies

Payroll Tax Calculator For Employers Gusto

Solved Calculation Of Taxable Earnings And Employer Payroll Taxes Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks